Resource library

Real tools for real financial growth

This is your go-to library for practical tools, trusted platforms, and financial education that actually supports your life, not just generic advice.

We prioritize transparency and include a mix of our own resources and thoughtfully selected tools we genuinely recommend.

Pricing Key (… because transparency matters 🤓)

- Free = No cost

- $ = $0–$50

- $$ = $51–$300

- $$$ = $300+

Pricing reflects typical cost at the time of listing and may change.

Important Disclosure: Some content on this page may include affiliate links. However, we only recommend products and tools we use or believe in.

Start here

Mindset & Money Psychology

Money isn’t just math and numbers. It’s emotional and deeply shaped by our lived experiences. These tools are here to support women of color in unpacking money beliefs, building confidence, and healing the relationship with money in a way that feels affirming and grounded in real life.

Free

Money Reflection Workbook

Our guided reflection workbook that helps you explore your financial past, understand your present patterns, and clarify the future you want to build with money.

Cost varies

Find a Financial Therapist

A directory of financial therapists and related professionals who support the emotional side of money, including stress, shame, trauma, and money-related relationship challenges.

Digital tools

Budgeting & money tracking apps

These apps can help you stay organized, track your spending, and build stronger day-to-day money habits. Each option below has a slightly different style, so you can choose what best fits your brain and your life.

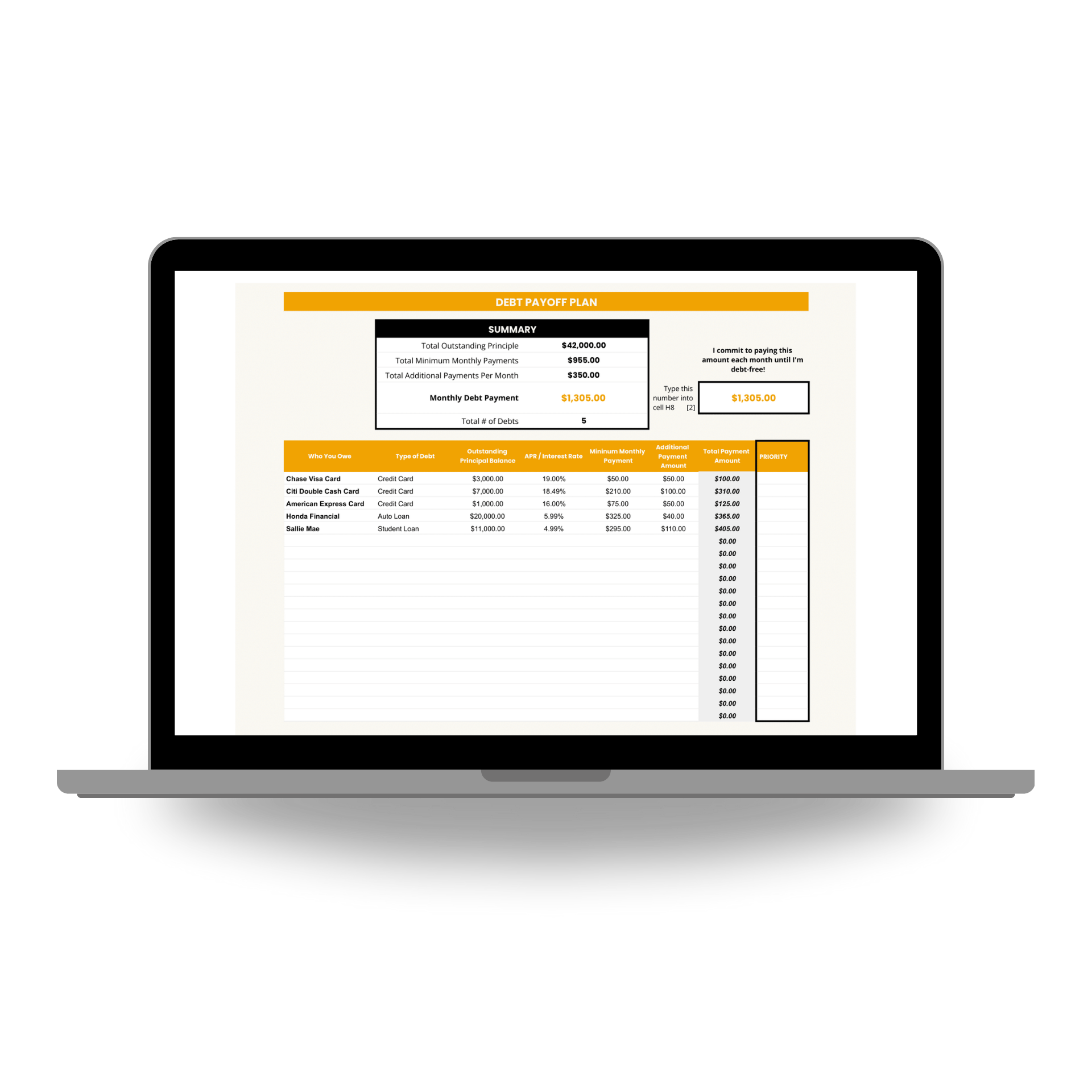

Free Tools

Start with these practical trackers

Our free trackers help you get organized and build better money habits.

Resources FAQ

Answers to your most pressing questions:

Q. Are these resources created by Wealth for Women of Color?

Some are, and some aren’t. This page includes a mix of our own tools and resources, alongside carefully selected apps, books, platforms, and tools we genuinely believe are helpful. Everything here is curated with intention, not sponsored placements.

Q. Do you make money from any of these links?

Great question! You should always understand how companies make money. 🙂

In addition to our own paid products and services, some links may be affiliate links. This means we may earn a small commission if you use them, at no extra cost to you. We only recommend tools and resources we truly trust and would share regardless. (And in some cases, we’re able to extend special deals and discounts!)

Q. What makes these resources specifically for women of color?

These resources are curated with women of color in mind — meaning we prioritize tools and education that are culturally aware, emotionally supportive, and grounded in real-life context.

We consider factors like first-generation wealth building, family expectations, systemic barriers, and the emotional side of money, not just technical advice. The goal is to offer resources that feel relevant, affirming, and actually usable in real life.

Q. I feel overwhelmed. Where should I start?

Start small. If you’re new to all of this, begin with the Mindset & Money Psychology section, then explore the free trackers or budgeting apps. You don’t need to use everything — just choose one tool that feels supportive and take it step by step.

More to come!

New resources are in the works — designed to support real-life money decisions and real financial growth.